Upstream Efficiency in the Oil Industry

Oil production in the U.S. has seen a steady long-term incline over the last few years. Between 2011 and 2014, the total number of “crude oil and lease condensate” increased by more than 3 million barrels per day, according to the Energy Information Administration. The oil industry itself feeds numerous others, which is why efficiency throughout operations can positively impact the speed and completeness of logistical deployments down the supply chain.

But for as large of an operation as it is, the U.S. oil sector and its companies could benefit from tightening up processes occurring at the very start of an extraction cycle, what is known as the “upstream” segment. In many ways, this under-appreciated section could increase efficiency and overall operational value or disrupt processes in a significant and costly manner. If oil companies seek to improve the efficiency throughout their distribution network, what changes or advancements should be made upstream so they trickle down into other sectors?

“Planning may only make up one-tenth of 1 percent of a well’s total cost.”

Investments in data-intensive oil IT intelligently utilize waning or underfunded resources

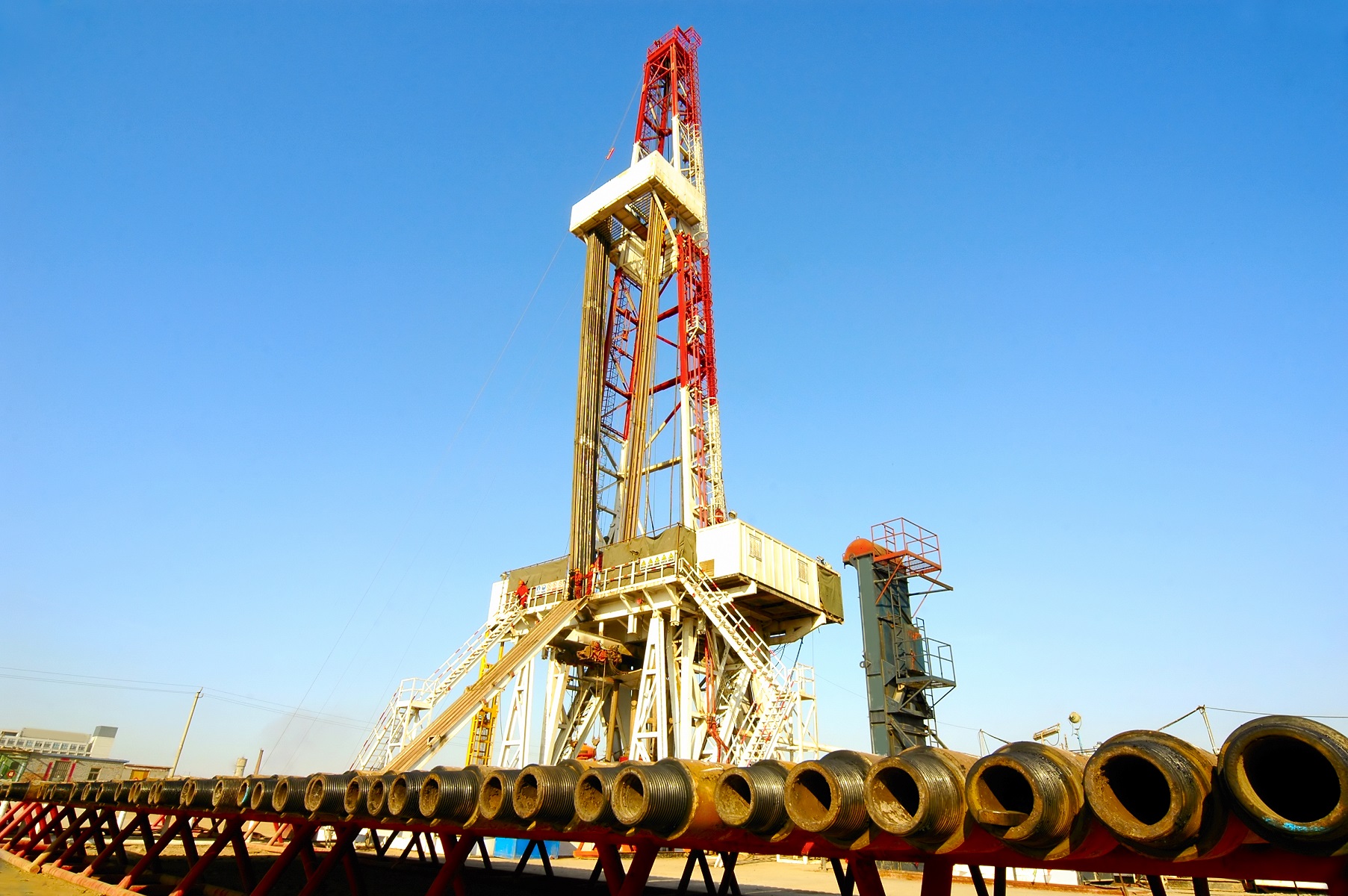

Before a drill breaks ground on a new oil well, planning teams collect an extensive amount of data on the geological characteristics of the earth they plan to bore through. As discussed by the Society of Petroleum Engineers (SPE), this process includes layers upon layers of detail including mud weights and formation pressures among other criteria, any of which could negatively affect drilling and extraction should they go unaccounted.

Unfortunately, SPE also concluded, on average, the budget for planning may only make up one-tenth of 1 percent of a well’s total cost, even though the earliest stages of upstream oil operations have the potential to disrupt so much else in later executions. Accessing, communicating and distributing pertinent data points through greater IT deployments can increase the efficacy of planning, allowing this section of operations to enhance others. That said, oil companies should be sure to invest in intelligent and inter-operable production management tools and strategies evenly weighted along all sections of planning, drilling, exploration, extraction, and distribution.

Additionally, enhanced data analytics have also shown to help balance an emerging skills gap among oil industry workers. According to a report by the International Data Corporation on oil industry predictions for 2015 and beyond, many oil companies making IT investments cite labor shortages in employees under 45 years of age as a primary reason for taking the plunge.

How extraction teams navigate a drill through the earth can increase or decrease efficiency depending on many factors.

Rethink drill functions for greater operational efficiency

Once drilling and extraction has been completed, the petroleum industry begins what it calls the “midstream” and “downstream” sectors. After resources are pulled from the earth, they undergo refining and commercial distribution. Though scouting locations and establishing exploratory drills might be the official kick-off to an oil supply chain, conducting thorough drills to hunt down viable wells can set a precedent for how smoothly processes move down the line, as well as causing fluctuations in the price of the product, according to Tortoise Capital Advisors.

“Only 42 percent of drilling operations actually involve drilling.”

While the latter aspect is not unknown to the industry at large, the interests of the companies collecting oil should be the engine behind productivity and volume. These businesses and their successes or failures should not be dictated by malfunctioning equipment or processes fraught with waste.

Managers and supervisors in the upstream petroleum sector should therefore look to increase efficiency and hone drilling operations as much as possible, as this integral area of work has traditionally seen its fair share of inefficiency. According to research by IDC and SAS, the cost of drilling versus the time spent performing drill-related operations doesn’t exactly align. In a 2011 assessment, though drilling constitutes half of all expenses pertaining to the creation and use of oil wells, only 42 percent of drilling operations actually involve drilling, while 58 percent directly relates to “drilling problems, rig movement, defects and waiting periods.”

Horizontal drilling, while beneficial to extraction, can be one factor leading to trouble in upstream operations resulting in lost uptime and lost efficiency. Though this action allows well crews to observe a greater breadth of possible oil acquisition in the exploratory stages, advanced well tortuosity can restrict drills and snag them against the wellbore, slowing processes to a halt until the drill can be jostled free. To protect against these issues, World Oil suggests strategizing on ways to increase the rate of penetration, or ROP. This can be achieved by replacing outdated equipment that cannot handle extreme wellbore bends, addressing the material used to coat the wellbore – if any coating is used at all – or adjusting drilling trajectory during the planning stages to avoid a steep angle. Again, complementing improved drilling strategies with more comprehensive IT deployments during the planning stages can avoid a higher rate of risk during exploratory and extraction segments.