Strategic Sourcing and the Impact of Falling Oil Prices

What do low oil prices mean for how companies source and manage their supply chains?

As economists know, price fluctuations for commodities like oil impact more than the oil and gas industry – as a source of energy, and a production resource, its market value has the power to reverberate through any sector that utilizes gas-powered transportation in its supply chain and oil products in its manufacturing practices. According to The New York Times, the price of a barrel of oil fell more than 70 percent between June 2014 and mid-February 2016, and in the last year alone, national unleaded gasoline prices dropped about $0.43 per gallon.

Resource procurement for any pertinent business is highly susceptible to flux when oil prices rise or dip. What do low oil prices mean for how companies source and manage their supply chains?

“Spending less at the gas station opens up cash flow on-site.”

Lowered logistical costs

Obviously, decreases in oil prices lead to cost reductions in fueling a fleet. The U.S. Energy Information Administration reported that between February 2015 and 2016, the price of diesel fell by more than $0.60 per gallon. For businesses with their own logistics arm, spending less on fuel opens up cash flow on-site, as well as room in the budget for capital investments like fleet expansion, asset acquisition, etc.

Businesses investing in third-party logistics (3PL) may also see spend reductions if their contracts stipulate their 3PL fuel surcharges are tied to changes in the oil market. Additionally, depending on the type of transportation in question, 3PLs and their partnering businesses may see greater cost reductions, according to Nabil Popalyar, account manager of transport benchmarking for CLX Logistics Europe. Fuel costs for air travel, for instance, make up a greater percentage of the logistics “pie” than ground transport, and thus may see greater margins.

Lastly, businesses contracting 3PLs may also be presented with shorter-term contracts upon renewal, as logistics providers try to hedge their bets against future oil prices. In negotiations, this could be a point of leverage businesses could use to their advantage.

Increased investment opportunities

As mentioned earlier, with freed up procurement funds, CPOs may look to invest in smarter sourcing regardless of a company’s logistical situation. So, what’s on the average CPO’s wish list? For starters, next-generation supply chain technology, according to research from PricewaterhouseCoopers.

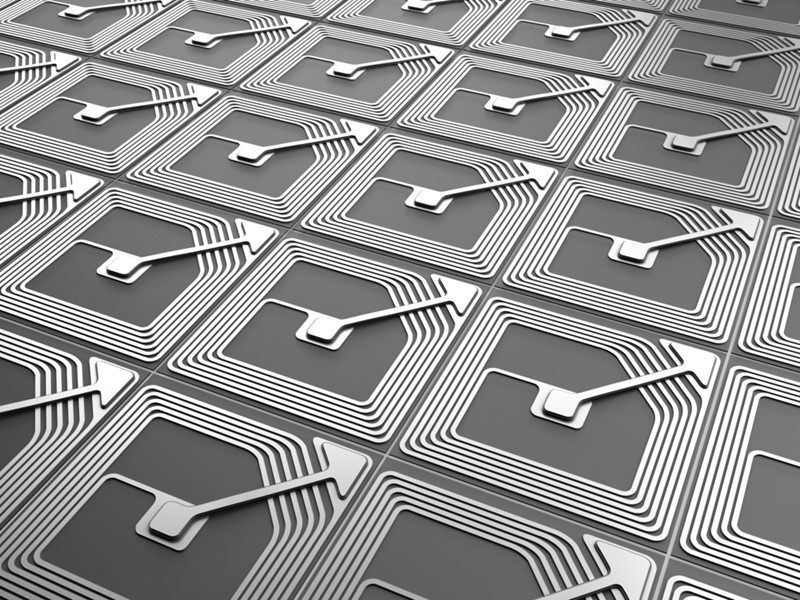

A PwC study found more than half of all business leaders have invested or will invest in “new tools to improve visibility and provide more process automation,” like RFID and data analytics equipment. Due to a recent heightening of regulation in the food and beverage industry in particular, pertinent businesses may also make worthwhile investments toward procuring sourcing information along the supply chain as much as the resources themselves.

RFID tag investments are just one way businesses can bring transparency to their procurement.

Furthermore, gains from falling oil prices may be reallocated toward a greener energy portfolio like on-site renewable energy generation through solar. An argument can be made that falling oil prices are not completely economic, but rather, a shift in public perception to energy and carbon emissions.

A reduction in a company’s carbon footprint can have a positive impact client relations, so any effort to offset greenhouse gas with solar panels, wind farms or energy efficiency programs can be a boon to marketing. Moreover, setting a tangible example allows for greater leverage in client relations. Green businesses can push suppliers to adopt more sustainable practices and reap the competitive advantages of doing so once suppliers turn over a new leaf.